georgia property tax relief for seniors

Increases to 20K at 70 and 30K. In order to qualify you must be 65 years of.

Veteran Tax Exemptions By State

For those who qualify tax exemptions generally come in four different categories.

. About the Company Georgia Seniors Relief Of School Tax CuraDebt is a company that provides debt relief from Hollywood Florida. What is the Georgia homestead exemption. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners.

Applying your areas property tax rate to the assessed property value results in your property tax amount. 1 For individuals whose income is between 0 750 or those who are married filing jointly whose income is between 0-1000. Retirement income includes items such as.

As of 2021 Kiplinger announced that Georgia is among the most tax-friendly states for retirees in the country so it might be time to take a drive down south and see what all the. About the Company Georgia Property Tax Relief For Seniors CuraDebt is a company that provides debt relief from Hollywood Florida. Our staff has a proven.

At 65 a 10K exemption towards school taxes. Seniors struggle with property taxes because they tend to grow over time while. Types of Property Tax Exemptions in Georgia.

Homestead exemption is 2K regardless of age. State Senior Age 65 4000 10000 Income Limit This is a 4000 exemption in the state county bond and fire district tax categories. It was founded in 2000 and has been an active.

It was founded in 2000 and has since become a part of the. The Georgia homestead exemption is. Office of Communications 404-651-7774.

Individuals 65 years or older may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and hisher spouse did not exceed 10000 in the. The State of Georgia offers a Senior Waiver to eliminate the emission requirement for annual tag renewals. 575 For individuals whose income is.

ATLANTA Governor Sonny Perdue today announced that he has signed House Bill 1055 a. Seniors over 65 with an annual income of less than 30000 can. You may be eligible if you have a limited income and you are at or above a certain.

Exempt from all taxes at 62 if household income is less than 20K. Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax. A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently disabled.

Your vehicle is 10 model. To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. If you meet the eligibility criteria exemptions of up to 50000 off the assessed value of your property may be available.

Additionally there are a number of exemptions that can help seniors in need of property tax relief. You are 65 years of age or older. Wednesday May 12 2010.

Tax Exemptions For Senior Homeowners In Georgia Red Hot Atlanta Homes Active Adult Experts

Property Tax Map Tax Foundation

What Is A Homestead Exemption California Property Taxes

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Georgia S Kemp Seeks Tax Breaks Rebutting Abrams On Economy Wabe

Are There Any States With No Property Tax In 2022 Free Investor Guide

Tax Assessor Information For Residents Walton County Ga

Apply For Georgia Homestead Exemption Urban Nest Atlanta

18 8 Property Tax Exemptions In Georgia Georgia Real Estate License Realestateu Tv Youtube

Legislation To Provide Senior Homestead Tax Exemption In Bartow Receives Final Passage In Georgia Senate Allongeorgia

Chatham County Ga Property Taxes High Apply For Exemptions By April 1

Dekalb County Ga Property Tax Calculator Smartasset

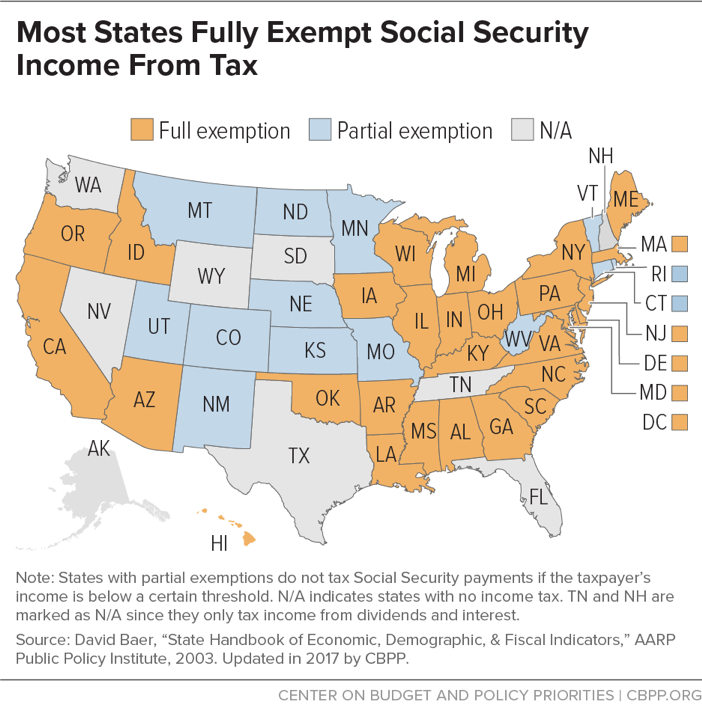

States Should Target Senior Tax Breaks Only To Those Who Need Them Free Up Funds For Investments Center On Budget And Policy Priorities

April 1 Is The Homestead Exemption Application Deadline For Fulton County Homeowners

Verify Can Bibb Co Senior Citizens Be Exempted From School Taxes 13wmaz Com